Deposits and FRAs

[1]:

import sys

import math

from dateutil.relativedelta import relativedelta

import datetime as dt

from rivapy.tools._validators import print_member_values

from rivapy.marketdata import DiscountCurve

from rivapy.instruments import DepositSpecification, ForwardRateAgreementSpecification

from rivapy.pricing import price

from rivapy.tools.enums import DayCounterType, InterpolationType, ExtrapolationType

from rivapy.pricing.pricing_data import DepositPricingData, ForwardRateAgreementPricingData

from rivapy.pricing.pricing_request import ForwardRateAgreementPricingRequest

from rivapy.pricing.pricing_request import DepositPricingRequest

from rivapy.pricing.bond_pricing import DeterministicCashflowPricer

from rivapy.pricing.deposit_pricing import DepositPricer

from rivapy.pricing.fra_pricing import ForwardRateAgreementPricer

from rivapy.tools.datetools import _term_to_period, DayCounter, roll_day

import matplotlib.pyplot as plt

import numpy as np

from matplotlib.dates import date2num, DateFormatter

from rivapy.tools.visualization import plot_deposit, plot_fra

%matplotlib inline

C:\Users\GunnarSalentin\OneDrive - RIVACON GmbH\Dokumente\git\RiVaPy\rivapy\__init__.py:11: UserWarning: The pyvacon module is not available. You may not use all functionality without this module. Consider installing pyvacon.

warnings.warn('The pyvacon module is not available. You may not use all functionality without this module. Consider installing pyvacon.')

Definition of a deposit

A deposit is simply a short-term bond where at the start date the lender pays the nominal amount \(N\) to the borrower, and at maturity plus settlement days (i.e. the payment date) the borrower pays back the nominal amount plus the accrued interest. Interest is usually expressed using simple compounding, i.e. the amount paid back at the payment date is \(N \cdot (1 + r \cdot \tau)\) where \(r\) is the interest rate and \(\tau\) is the year fraction between start and end date.

Deposits can be setup in RIVAPY by providing start and end dates directly or by providing a start date and a term. Other instrument specific dates, e.g. fixing date, end date, or maturity date can be passed explicitly when setting up the instrument or will be derived from default values, e.g. spot_days of 2 days, and business day convention.

[2]:

# Set up deposit specification

ccy = 'EUR'

ref_date = dt.datetime(2023, 1, 2)

issue_date = ref_date

maturity_date = dt.datetime(2024, 1, 26)

dcc = 'Act360'

rate = .03

notional = 100.

deposit_spec = DepositSpecification(

obj_id='dummy_id',

issuer="",

currency=ccy,

issue_date=issue_date,

maturity_date=maturity_date,

notional=notional,

rate=rate,

day_count_convention=dcc,

roll_convention='NONE',

payment_days = 5,

spot_days = 5

)

print_member_values(deposit_spec)

schedule = deposit_spec.get_schedule()

print("Schedule details:")

dates = schedule._roll_out(

from_=schedule.start_day,

to_=schedule.end_day,

term=schedule.time_period,

ref_date=ref_date

)

for date in dates:

print(date.strftime("%Y-%m-%d"))

Number of annual payments is not a whole number but a decimal.

Inspecting instance of DepositSpecification:

accrual_dates: [datetime.datetime(2023, 1, 2, 0, 0), datetime.datetime(2024, 1, 26, 0, 0)]

adjust_accruals: True

adjust_end_date: False

adjust_schedule: True

adjust_start_date: True

backwards: True

business_day_convention: ModifiedFollowing

calendar: {datetime.date(2023, 1, 1): "New Year's Day", datetime.date(2023, 4, 7): 'Good Friday', datetime.date(2023, 4, 10): 'Easter Monday', datetime.date(2023, 5, 1): 'Labour Day', datetime.date(2023, 12, 25): 'Christmas Day', datetime.date(2023, 12, 26): 'Christmas Holiday', datetime.date(2024, 1, 1): "New Year's Day", datetime.date(2024, 3, 29): 'Good Friday', datetime.date(2024, 4, 1): 'Easter Monday', datetime.date(2024, 5, 1): 'Labour Day', datetime.date(2024, 12, 25): 'Christmas Day', datetime.date(2024, 12, 26): 'Christmas Holiday'}

coupon: 0.03

coupon_type: fix

currency: EUR

dates: [datetime.datetime(2023, 1, 2, 0, 0), datetime.datetime(2024, 1, 26, 0, 0)]

day_count_convention: Act360

end_date: 2024-01-26 00:00:00

frequency: 389D

index: None

ir_index: None

issue_date: 2023-01-02 00:00:00

issue_price: None

issuer:

last_fixing: None

maturity_date: 2024-01-26 00:00:00

notional: <rivapy.instruments.components.ConstNotionalStructure object at 0x000001A23C0E75F0>

notional_exchange: True

nr_annual_payments: 0.9383033419023136

obj_id: dummy_id

payment_days: 5

pays_in_arrears: True

rate: 0.03

rating: NONE

roll_convention: NONE

schedule: <rivapy.tools.datetools.Schedule object at 0x000001A23C2DF620>

securitization_level: NONE

spot_days: 5

start_date: 2023-01-02 00:00:00

stub_type_is_Long: True

Schedule details:

2023-01-02

2024-01-26

[3]:

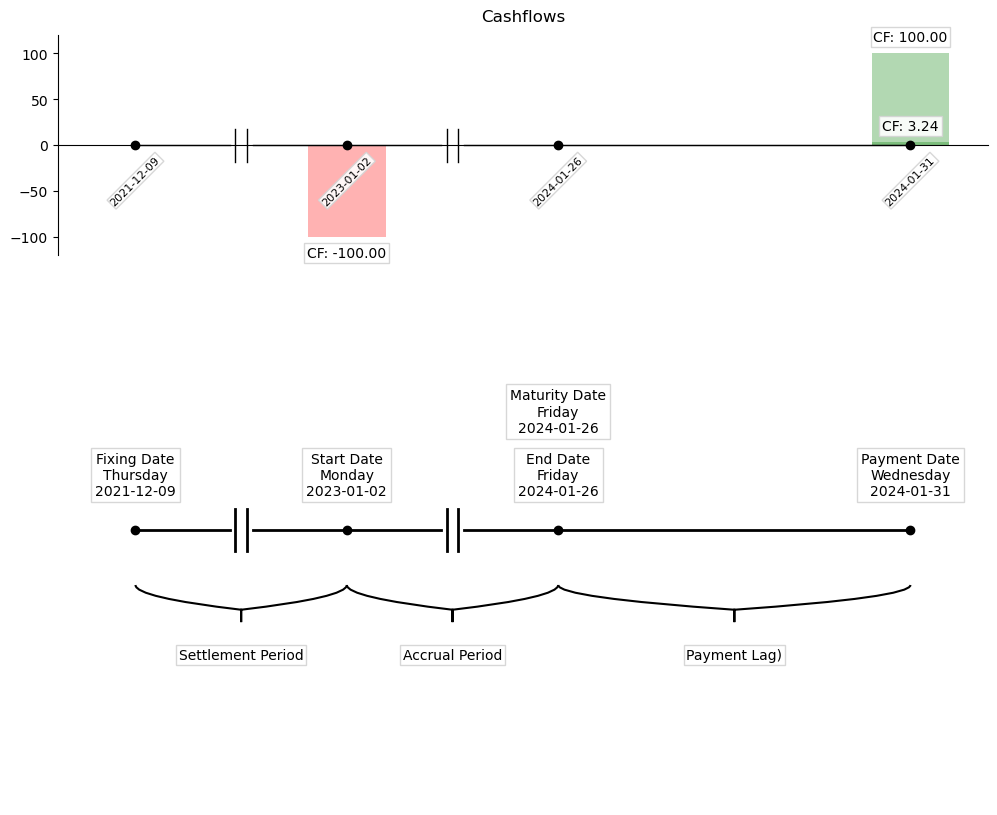

cf = DepositPricer.get_expected_cashflows(deposit_spec)

print(f"Cashflows: {cf}")

print("\nPricing deposit:")

# add timeline plot

fig = plot_deposit(deposit_spec, ref_date)

plt.show()

End dates of notional structure are not set.

End dates of notional structure are not set.

Cashflows: [(datetime.datetime(2023, 1, 2, 0, 0), -100.0), (datetime.datetime(2024, 1, 31, 0, 0), 3.2416666666666663), (datetime.datetime(2024, 1, 31, 0, 0), 100.0)]

Pricing deposit:

[4]:

term = "3M"

deposit_spec_3M = DepositSpecification(

obj_id='dummy_id',

issuer="",

currency=ccy,

issue_date=ref_date,

term=term,

notional=notional,

rate=rate,

day_count_convention=dcc,

roll_convention='NONE', # explicitly pass as string

payment_days=0

)

print_member_values(deposit_spec_3M)

Inspecting instance of DepositSpecification:

accrual_dates: [datetime.datetime(2023, 1, 2, 0, 0), datetime.datetime(2023, 4, 3, 0, 0)]

adjust_accruals: True

adjust_end_date: False

adjust_schedule: True

adjust_start_date: True

backwards: True

business_day_convention: ModifiedFollowing

calendar: {datetime.date(2023, 1, 1): "New Year's Day", datetime.date(2023, 4, 7): 'Good Friday', datetime.date(2023, 4, 10): 'Easter Monday', datetime.date(2023, 5, 1): 'Labour Day', datetime.date(2023, 12, 25): 'Christmas Day', datetime.date(2023, 12, 26): 'Christmas Holiday', datetime.date(2024, 1, 1): "New Year's Day", datetime.date(2024, 3, 29): 'Good Friday', datetime.date(2024, 4, 1): 'Easter Monday', datetime.date(2024, 5, 1): 'Labour Day', datetime.date(2024, 12, 25): 'Christmas Day', datetime.date(2024, 12, 26): 'Christmas Holiday', datetime.date(2021, 1, 1): "New Year's Day", datetime.date(2021, 4, 2): 'Good Friday', datetime.date(2021, 4, 5): 'Easter Monday', datetime.date(2021, 5, 1): 'Labour Day', datetime.date(2021, 12, 25): 'Christmas Day', datetime.date(2021, 12, 26): 'Christmas Holiday'}

coupon: 0.03

coupon_type: fix

currency: EUR

dates: [datetime.datetime(2023, 1, 2, 0, 0), datetime.datetime(2023, 4, 3, 0, 0)]

day_count_convention: Act360

end_date: 2023-04-02 00:00:00

frequency: 3M

index: None

ir_index: None

issue_date: 2023-01-02 00:00:00

issue_price: None

issuer:

last_fixing: None

maturity_date: 2023-04-03 00:00:00

notional: <rivapy.instruments.components.ConstNotionalStructure object at 0x000001A23C727B90>

notional_exchange: True

nr_annual_payments: 4.0

obj_id: dummy_id

payment_days: 0

pays_in_arrears: True

rate: 0.03

rating: NONE

roll_convention: NONE

schedule: <rivapy.tools.datetools.Schedule object at 0x000001A23C580710>

securitization_level: NONE

spot_days: 2

start_date: 2023-01-02 00:00:00

stub_type_is_Long: True

[5]:

# Set up (flat) rate curve

object_id = "TEST_CURVE"

flat_rate = 0.025

days_to_maturity = [1, 180, 365, 720, 3 * 365, 4 * 365, 10 * 365]

dates = [ref_date + dt.timedelta(days=d) for d in days_to_maturity]

df = [math.exp(-d / 365.0 * flat_rate) for d in days_to_maturity]

dc = DiscountCurve(id=object_id, refdate=ref_date, dates=dates, df=df, interpolation = InterpolationType.LINEAR, extrapolation=ExtrapolationType.LINEAR)

[6]:

# price deposit

print (f"Expected Cashflows: {DeterministicCashflowPricer.get_expected_cashflows(deposit_spec,ref_date)}")

print(f"Price Deposit: {DepositPricer.get_price(ref_date, deposit_spec, dc)}")

# Determine fair rate

fair_rate = DepositPricer.get_implied_simply_compounded_rate(ref_date, deposit_spec, dc)

print(f"fair rate: {fair_rate}")

# new deposit with fair rate

fair_deposit_spec = DepositSpecification(obj_id ='dummy_id', issuer='dummy_issuer', securitization_level ='NONE',

currency=ccy, issue_date=ref_date, maturity_date=deposit_spec.end_date, notional=deposit_spec.notional, rate=fair_rate,

day_count_convention=deposit_spec.day_count_convention, payment_days=deposit_spec.payment_days, spot_days=deposit_spec.spot_days)

#print_member_values(fair_deposit_spec)

print(f"fair deposit coupon: {fair_deposit_spec.coupon}")

#print(DepositPricer.get_price(ref_date, fair_deposit_spec, dc))

End dates of notional structure are not set.

End dates of notional structure are not set.

Expected Cashflows: [(datetime.datetime(2023, 1, 2, 0, 0), -100.0), (datetime.datetime(2024, 1, 31, 0, 0), 3.2416666666666663), (datetime.datetime(2024, 1, 31, 0, 0), 100.0)]

Price Deposit: 100.4950269333136

fair rate: 0.024971370182974097

fair deposit coupon: 0.024971370182974097

[7]:

# Check fair rate

# discount factor from curve

print(f"fair_deposit_spec.start_date: {fair_deposit_spec.start_date}, fair_deposit_spec.end_date: {fair_deposit_spec.end_date}")

df_curve = dc.value_fwd(ref_date, fair_deposit_spec.start_date, fair_deposit_spec.end_date)

# discount factor implied by fair rate (simple compounding, Act/360)

dcc = DayCounter(fair_deposit_spec.day_count_convention)

#print(f"day count convention: {fair_deposit_spec.day_count_convention}")

delta_t = dcc.yf(fair_deposit_spec.start_date, fair_deposit_spec.end_date)

df_implied = 1. / (1. + delta_t * fair_rate)

#print(f"Discount factor from curve: {df_curve}, Delta t: {delta_t}, Implied DF: {df_implied}, dcc: {dcc}")

print(df_curve)

print(df_implied)

fair_deposit_spec.start_date: 2023-01-02 00:00:00, fair_deposit_spec.end_date: 2024-01-26 00:00:00

0.9737259973907282

0.9737259973907281

The deposit’s cashflows including relevant dates are shown below:

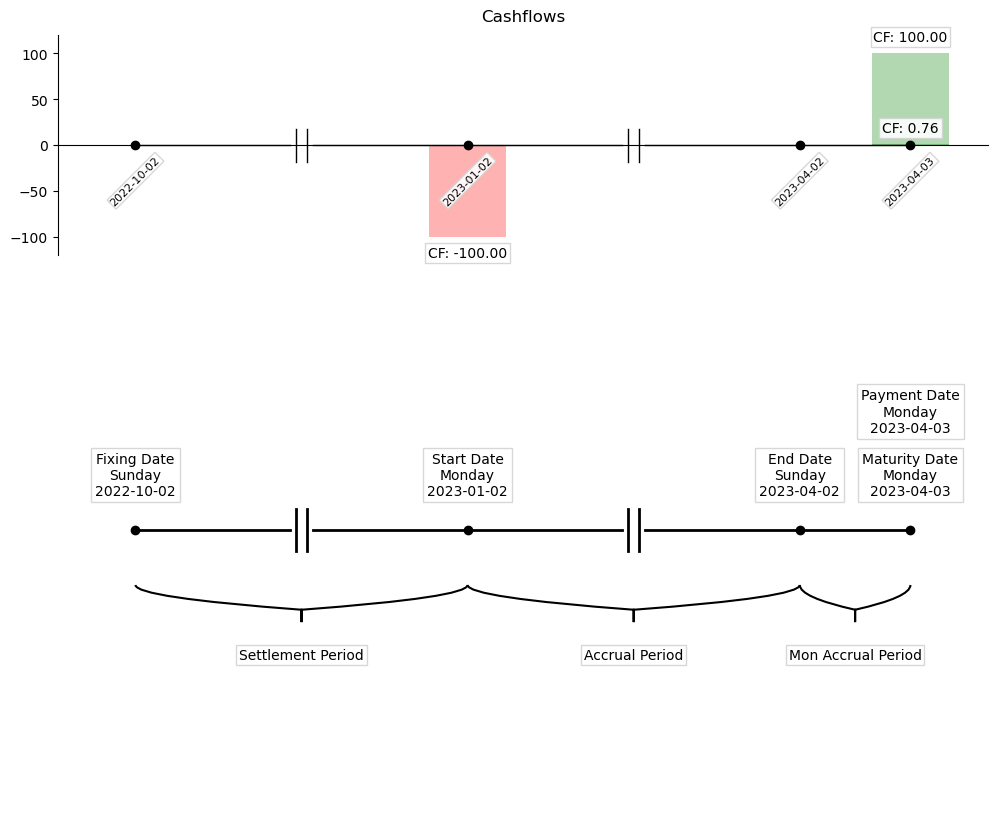

[8]:

fig = plot_deposit(deposit_spec_3M, ref_date)

plt.show()

Found start date 2022-10-02 00:00:00 such that calc_end_day(start_date, ...) == end_day, but start date is not a business day in the given calendar.

End dates of notional structure are not set.

Definition of a forward rate agreement (FRA)

A forward rate agreement is in principle a forward-starting deposit for a time period \([T_1, T_2]\) in the future (which is concluded at a start date \(T_0\)). However, rather than actually entering into a deposit at time \(T_1\), an FRA is “cash-settled” at \(T_1\) by exchanging the present value of the agreement (using the fixing of the underlying index to discount the cash flows from \(T_2\) to \(T_1\)):

\[PV(T_1) = N \tau \frac {r - K} {1 + r\cdot \tau}\]

where

\(N\) is the nominal amount

\(\tau\) is the year fraction between \(T_1\) and \(T_2\)

\(r\) is the index fixing at \(T_1\) for the period \([T_1, T_2]\)

\(K\) is the forward rate agreed upon at \(T_0\)

[9]:

# Set up FRA

ccy = 'EUR'

fra_rate = .04

ref_date = dt.datetime(2023, 1,28)

start_date = dt.datetime(2023, 7, 28)

end_date = dt.datetime(2023, 10, 28)

mat_date = ref_date + dt.timedelta(days=365)

fra = ForwardRateAgreementSpecification(

obj_id= 'dummy_id',

trade_date=ref_date,

#maturity_date=mat_date,

notional= 1000.0,

rate= fra_rate,

start_date=start_date,

end_date=end_date,

udlID= "dummy_underlying_index",

rate_start_date=start_date,

rate_end_date=end_date,

day_count_convention= 'Act360',

#business_day_convention: _Union[RollConvention, str] = RollConvention.FOLLOWING,

rate_day_count_convention= 'Act360',

#rate_business_day_convention: _Union[RollConvention, str] = RollConvention.FOLLOWING,

#calendar: _Union[_HolidayBase, str] = None,

currency=ccy,

# ex_settle: int =0,

# trade_settle: int= 0,

spot_days = 1,

payment_days = 1,

#start_period: int = None,

#end_period: int = None,

issuer= "dummy_issuer",

securitization_level= "NONE",

#rating: _Union[Rating, str] = Rating.NONE, ''

)

[10]:

# Set up curves for pricing

# Discount curve

object_id = "TEST_DC"

dsc_rate = 0.01

days_to_maturity = [1, 180, 365, 720, 3 * 365, 4 * 365, 10 * 365]

dates = [ref_date + dt.timedelta(days=d) for d in days_to_maturity]

df = [math.exp(-d / 365.0 * dsc_rate) for d in days_to_maturity]

dc = DiscountCurve(id=object_id, refdate=ref_date, dates=dates, df=df, interpolation= InterpolationType.LINEAR)

# Fixing curve

object_id = "TEST_fwd"

fwd_rate = 0.05

fwd_df = [math.exp(-d / 365.0 * fwd_rate) for d in days_to_maturity]

fwd_dc = DiscountCurve(id=object_id, refdate=ref_date, dates=dates, df=fwd_df,interpolation= InterpolationType.LINEAR)

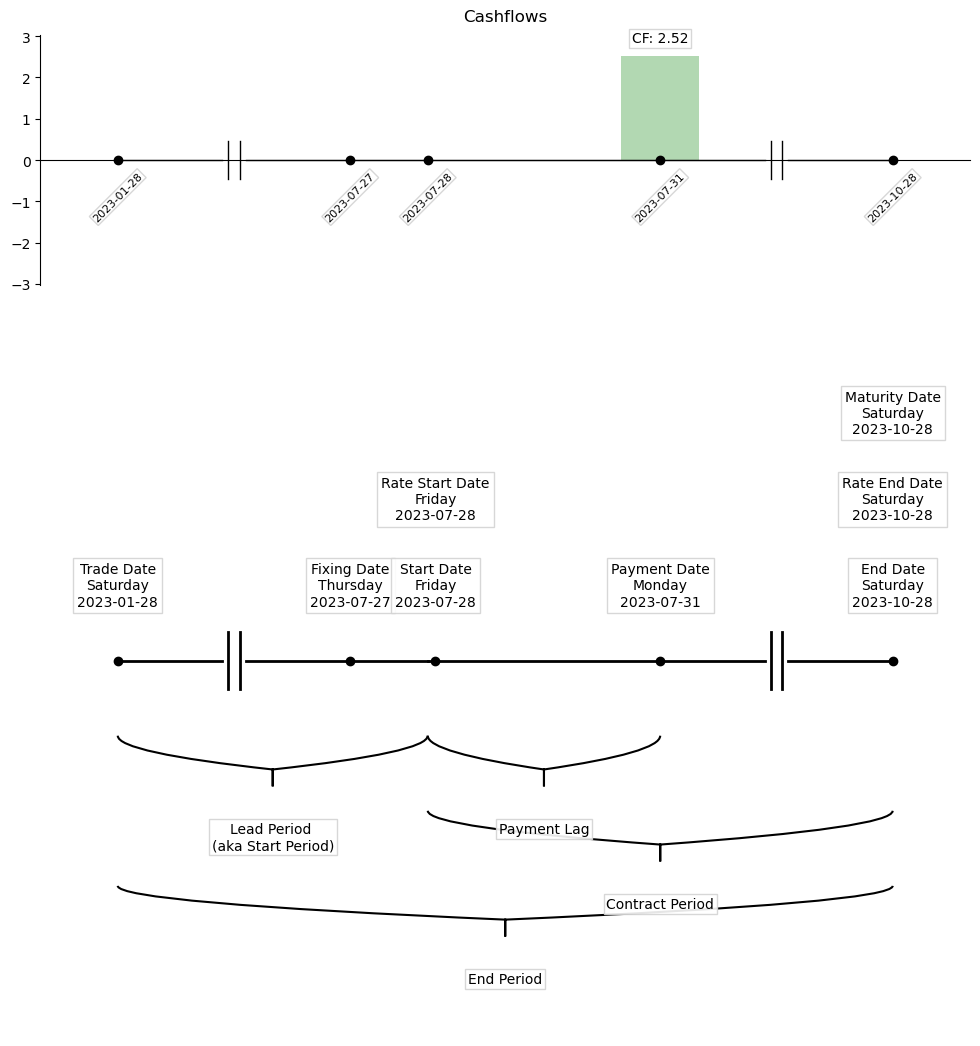

[11]:

fig = plot_fra(fra, ref_date, fwd_dc)

plt.show()

print(fra._maturity_date)

Day count fraction (yf): 0.25205479452054796, Forward rate: 0.05000074869501186

dt: 0.25555555555555554, Specification_Rate: 0.04, Amount: 2.555746888725252

Cashflow: 2.5235016624312805

2023-10-28 00:00:00

[12]:

# Price FRA

fra_pricing_data = ForwardRateAgreementPricingData(fra= fra, val_date= ref_date, pricing_request = ForwardRateAgreementPricingRequest(),

pricer = "ForwardRateAgreementPricer", discount_curve = dc, forward_curve = fwd_dc,

parameters = {})

fra_pricer = ForwardRateAgreementPricer(ref_date, fra, dc, fwd_dc)

fra_price = fra_pricing_data.price()

# print(f'Price: {fra_price}')

# expCF = fra_pricer.expected_cashflows()

# print(f'Expected Cashflows: {expCF}')

Day count fraction (yf): 0.25205479452054796, Forward rate: 0.05000074869501186

dt: 0.25555555555555554, Specification_Rate: 0.04, Amount: 2.555746888725252

Cashflow: 2.5235016624312805

[13]:

# Calculate fair FRA rate (from froward curve)

pricer = ForwardRateAgreementPricer(val_date= ref_date, fra_spec = fra, discount_curve=dc, forward_curve=fwd_dc )

fair_rate = ForwardRateAgreementPricer.compute_fair_rate(ref_date, fra, fwd_dc)

print(fair_rate)

0.05000074869501186

[14]:

# Check that "fair" FRA has indeed price 0, use same instrument as before but apply the fair rate from the previous step

fair_fra = ForwardRateAgreementSpecification(

obj_id= 'fair_dummy_id',

trade_date=ref_date,

maturity_date=mat_date,

notional= 1000.0,

rate= fair_rate,

start_date=start_date,

end_date=end_date,

udlID= "dummy_underlying_index",

rate_start_date=start_date,

rate_end_date=end_date,

day_count_convention= 'Act360',

#business_day_convention: _Union[RollConvention, str] = RollConvention.FOLLOWING,

rate_day_count_convention= 'Act360',

#rate_business_day_convention: _Union[RollConvention, str] = RollConvention.FOLLOWING,

#calendar: _Union[_HolidayBase, str] = None,

currency=ccy,

# ex_settle: int =0,

# trade_settle: int= 0,

#spot_days: int = None,

#start_period: int = None,

#end_period: int = None,

issuer= "dummy_issuer",

securitization_level= "NONE",

#rating: _Union[Rating, str] = Rating.NONE, ''

)

fair_fra_pricing_data = ForwardRateAgreementPricingData(fra= fair_fra, val_date= ref_date, pricing_request = ForwardRateAgreementPricingRequest(),

pricer = "ForwardRateAgreementPricer", discount_curve = dc, forward_curve = fwd_dc,

parameters = {})

fair_fra_price = fair_fra_pricing_data.price()

print(f'Price: {fair_fra_price}')

Day count fraction (yf): 0.25205479452054796, Forward rate: 0.05000074869501186

dt: 0.25555555555555554, Specification_Rate: 0.05000074869501186, Amount: 0.0

Cashflow: 0.0

Price: 0.0